Academic Insight - Dr Hanwool Jang on financial market efficiency

In the first of our new series of academic insight blogs, Dr Hanwool Jang, a lecturer from the Department of Finance, Accounting, and Risk at Glasgow Caledonian, shares a fascinating piece of research that tests financial market efficiency using quantum mechanics.

My study, published in the journal Chaos, Solitons and Fractals, introduces an innovative method for testing financial market efficiency using quantum mechanics. I believe it has the potential to become a foundation for interdisciplinary research to revisit and refine traditional statistical tools in finance.

The paper proposes a new method for testing market efficiency using the Quantum Harmonic Oscillator (QHO) model. If you’re familiar with quantum mechanics, the QHO model is typically used to describe the subtle vibrations of diatomic molecules. However, this research takes it a step further by applying the concept to finance.

Currently, financial market efficiency is often evaluated using tools like the Variance Ratio Test (VRT). In this study, the VRT suggested that while Real Estate Investment Trusts (REIT) and general equities are inefficient, the bond market appears to be efficient.

However, the issue arises because most financial assets’ logarithmic price series don’t align with the assumptions of the VRT - the normality of the increments of the log price series, so the VRT can not be used to test the efficient market hypothesis.

This limitation led us to propose a fresh approach: the QHO model.

Here’s where it gets particularly intriguing. The QHO essentially describes how oscillating systems experience forces that return them to equilibrium. In the study, we argue that financial markets behave in a similar way - stock returns might fluctuate, but they tend to stabilise around a long-term trend. By leveraging this parallel, we adapted the QHO to analyse market behaviours more effectively.

The corresponding author, Professor Kwangwon Ahn, of Yonsei University, explains: “The connection between financial asset returns and quantum physics works because market uncertainty (or volatility) corresponds to properties of the quantum wave function. The collective trading activities of investors can be likened to the energy level of an oscillating particle, and volatility eventually returns to some equilibrium state.”

In essence, this research demonstrated that the probability associated with the ground state of an oscillating particle could be effectively applied to testing financial market efficiency.

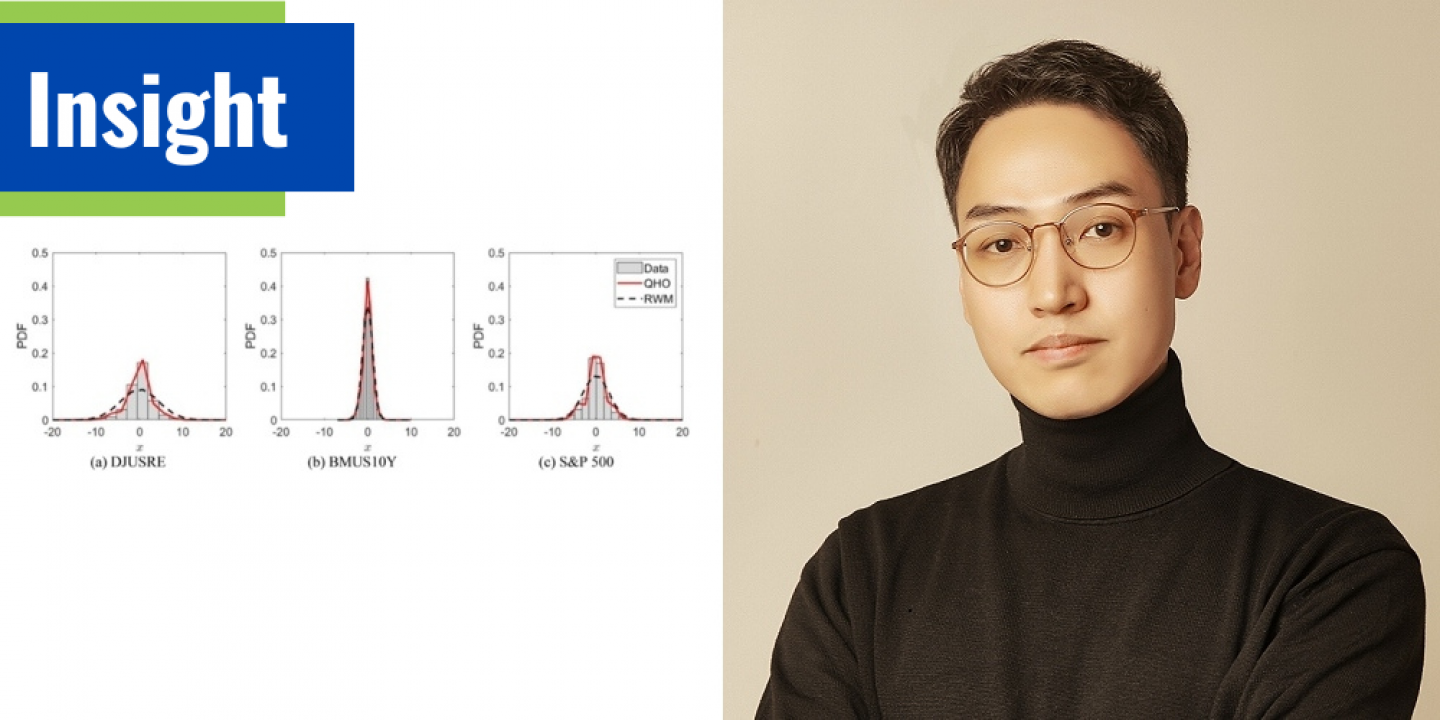

The QHO model was validated using data from the S&P 500, 10-year US Treasury bonds, and the Dow Jones US Real Estate Index. After confirming the robustness of the QHO model, we concluded that the REIT market exhibits higher efficiency compared to the general stock market.

The results are promising. In the next project, I plan to apply quantum computing to calculate the parameters of the QHO model in order to reduce computational costs. Using a quantum computer makes it more natural to think about the asset pricing model in the context of quantum finance.

- Revisiting Financial Market Efficiency Through Quantum Mechanics – Read the full paper